For most people, buying or refinancing a home is the most significant financial decision they will ever make. Because of this, the buyer will want to be certain to protect the investment. However, title insurance and what and who it protects can be very confusing, says Pottstown, PA title insurance company Heartland Abstract.

When a person buys a home, they hardly ever consider that they could become involved in a situation where there is a problem with the title, and perhaps someone else has a claim to the property. After all, this is what the mandatory title insurance policy is for, right? Not quite.

The mandatory policy required at the time of purchase protects the lender who is the policy's beneficiary. It is not designed to protect the homebuyer if a problem arises. That does not mean that the buyer has to remain unprotected, though. There are two options to protect the buyer, standard title insurance and enhanced title insurance.

.jpg)

What is Standard Title Insurance?

As the name suggests, a standard policy covers the homeowner for the basic matters affecting the title, including:

- Mechanic’s Lien Coverage

- Third-Party claims an interest in the title

- Improperly executed documents

- Mistakes in the public record

- Pre-Policy forgery, fraud, or duress

- Non-recorded restrictive covenants

- Defective recording of documents

- Prior recorded liens not disclosed in the policy

- Unmarketability of the title

There are, however, a wide range of errors and situations that could still threaten a buyer’s right to own the home even after investing money and taking out a loan to purchase it. Not all of those threats are covered under a basic policy. Because of this, buyers may want to consider upgrading to enhanced title insurance.

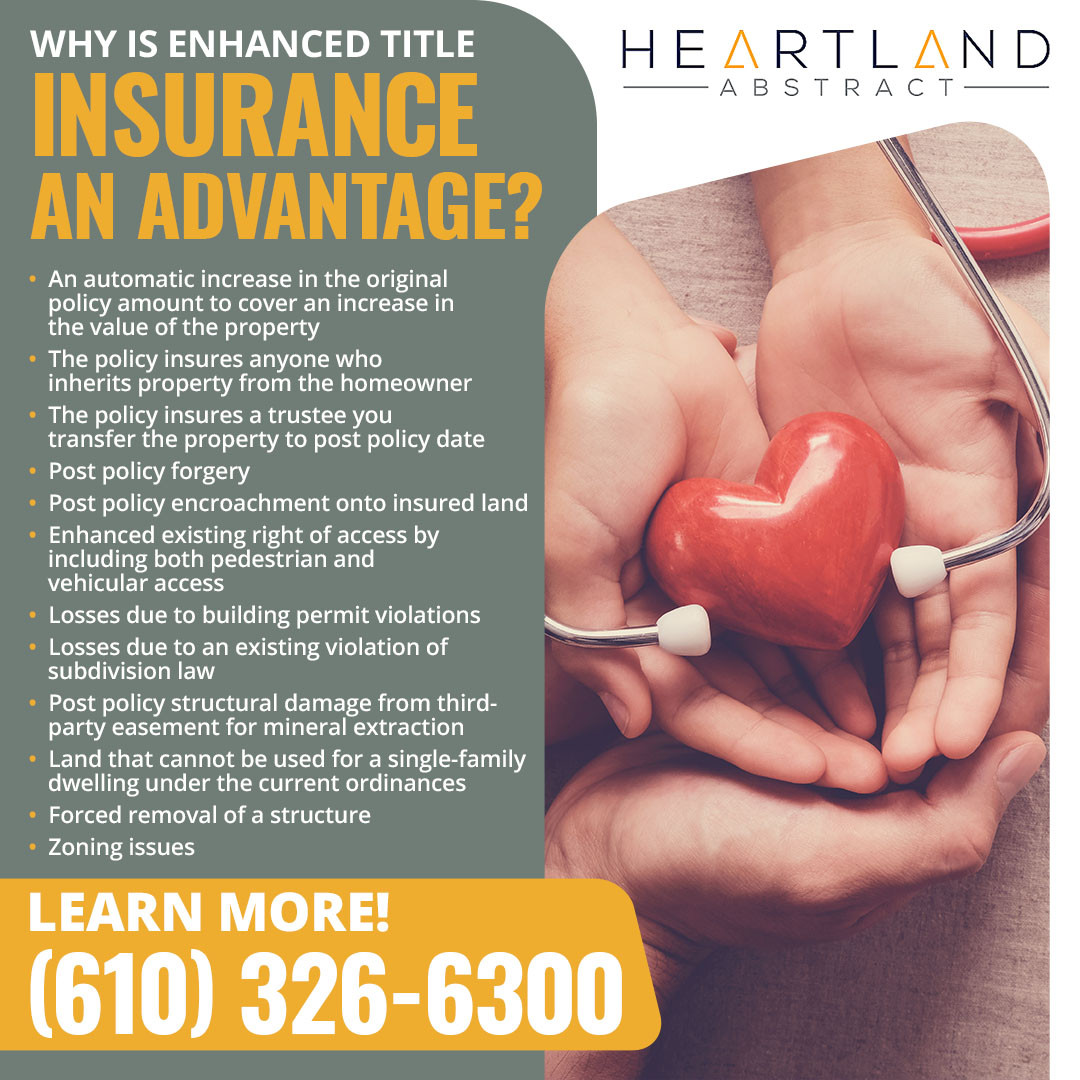

Why is Enhanced Title Insurance an Advantage?

Enhanced title insurance is an option for homebuyers and whether or not to opt in largely depends on the buyer’s risk tolerance. This type of title insurance covers all of the basic features and offers additional protections. This policy offers an advantage because it extends coverage to include:

- An automatic increase in the original policy amount to cover an increase in the value of the property

- The policy insures anyone who inherits property from the homeowner

- The policy ensures a Trustee you transfer the property to post policy date

- Post Policy Forgery

- Post Policy encroachment onto insured land

- Enhanced existing right of access by including both pedestrian and vehicular access

- Losses due to building permit violations

- Losses due to an existing violation of subdivision law

- Post policy structural damage from third-party easement for mineral extraction

- Land that cannot be used for a single-family dwelling under the current ordinances

- Forced removal of a structure

- Zoning issues

Enhanced title insurance also provides:

- Rights under leases not recorded

- Reimbursement for rental facility or land

- Lifetime insurance coverage

Because it is so robust, affordable, and generally not much more than the standard alternative, most people find it a worthwhile upgrade to protect their interest in the home.

Why Buyers Prefer Heartland Abstract

Not all title companies are created equal, and comparing options can save money in hidden fees that can get tacked on along the way. Many lenders and real estate agents view title insurance as a profit center and will use a buyer's confidence in them to lead them to their preferred title company. These companies often incur extra fees because they have to share profits with referring partners.

Heartland Abstract does things differently. Heartland does not share profits with anyone else and does not tack on extra charges or junk fees- ever.

Title Insurance Pottstown, PA and Surrounding Areas

Located in Pottstown, PA, Heartland Abstract is uniquely positioned to serve clients statewide. With over 20 years of exceptional service, Heartland Abstract can offer policies insuring any property in all 67 counties in Pennsylvania, primarily in Eastern Pennsylvania, including Montgomery, Berks, Chester, Lehigh, Delaware, Philadelphia Bucks, and Northampton Counties.

.jpg)